Insurance for Accommodation Providers

Business insurance made for Accommodation Providers

Compare free quotes

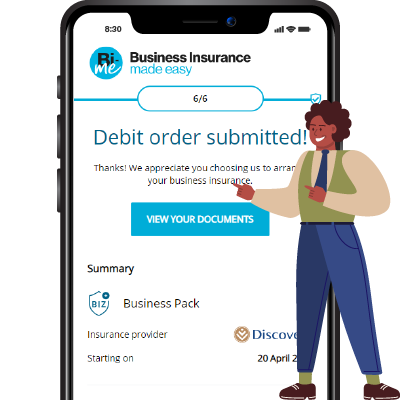

Buy online, no paperwork

Get instant cover

Get instant online insurance quotes from leading Insurers

Get obligation free Accommodation insurance quotes instantly online

Nobody knows your business better than you, so why spend hours on the phone explaining it to someone and then wait days for a quote? When you can get quotes from leading Insurers online and compare them side-by-side to get the best deal.

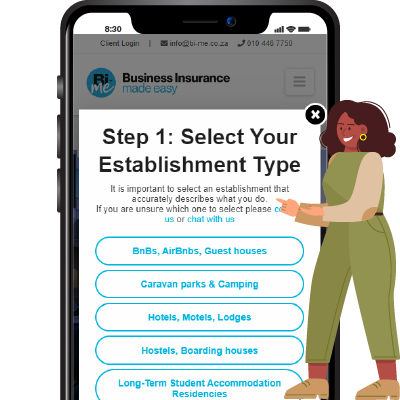

1. Select a business type

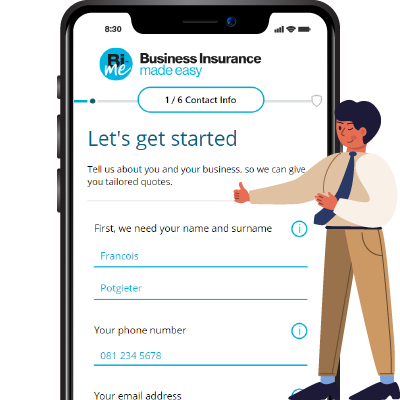

2. Tell us about you

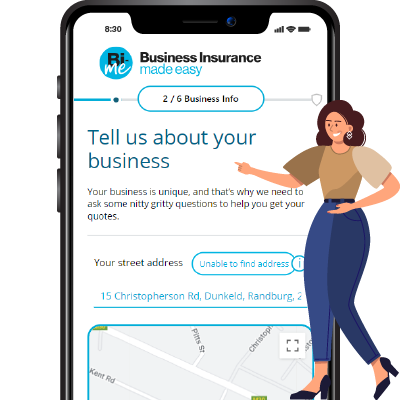

3. Customise your quotes

4. Get cover instantly

Why do Accommodation Providers need insurance?

While you look after all of your guests, we’ll definitely look after all of your business insurance needs. Whether you own a large hotel, provide student accommodation, run a guest house, a lodge or even a caravan park, we have got you covered. With just a few clicks or a single phone call you can get multiple competitive quotes from some of South Africa’s leading insurers, and get covered instantly.

What should I consider before purchasing insurance for my Accommodation business?

Ultimately protecting your business from unexpected events and challenges is where business insurance comes into play. It is however recommended to consider the following before purchasing insurance:

- Assess Your Risks: Understand potential liabilities, property vulnerabilities, and operational threats.

- Choose the Right Coverage: Select coverage that suits your specific accommodation type and size.

- Consider Special Features: Tailor coverage for unique needs like seasonal fluctuations or special events.

Fundamental insurance for Accommodation Providers

Buildings

Buildings are usually one of the most important assets for accommodation providers. Hence this can protect your business when your buildings are damaged due to fire, storm, earthquake, wind and more.

Contents

Contents insurance is designed to provide cover for the contents of your address when an insured event occurs – due to fire, storm or flood (for theft cover see the Theft section). The contents of an accommodation place should be covered in the contents – miscellaneous items section when you are doing the quoting journey.

If you own the building where your business activities take place, you might also consider Buildings insurance.

Public Liability

There are many possible accidents that could happen in an accommodation-providing environment. This cover is designed to provide protection for you and your business in the event that a customer, supplier or a member of the public is injured or sustains property damage as a result of your negligent business activities.

Personal injury claims could arise from a guest tripping over a small step, a guest slipping on a wet floor, or a heavy item falling on your guest.

Theft

Theft is one of the most common claims accommodation providers file on their insurance for. Your business might be the victim of theft or fraud from your guest or sometimes one of your employees may steal from you and you’ll need Employee Dishonesty cover.

The right business insurance will cover you against acts of theft and fraud, whether these come from your own employees or from outside of your business.

Regularly selected insurance for Accommodation Providers

Accidental Damage

Accidental damage covers loss from unexpected and unforeseen physical loss of or damage to business property at your premises; can also include damage caused by discharge or leakage of chemicals, oils, liquids, fluids, gases or fumes which can cause severe damage to your business.

Business Interruption

Business Interruption is important for the continuity in the accommodation industry. What happens if your building gets damaged and you cannot accommodate guests for a prolonged period of time? This type of insurance covers for financial loss as a result of an interruption to your business caused by an insured event (such as fire).

There is also an option to be covered if you are prevented from accessing your premises.

Electronic Equipment

There are many possible accidents that could happen in an accommodation-providing environment. This cover is designed to provide protection for you and your business in the event that a customer, supplier or a member of the public is injured or sustains property damage as a result of your negligent business activities.

Personal injury claims could arise from a guest tripping over a small step, a guest slipping on a wet floor, or a heavy item falling on your guest.

Glass

Glass is a very expensive element in a building and can cost an arm and a leg to replace if it breaks. Many accommodation providers have large glass panes. This glass can range from the outward-facing windows of your building to the internal glass and mirrors in the rooms you rent out.

Accidents happen, and many businesses get this cover to protect themselves against damage to their glass.

Get obligation free insurance quotes online in real-time

Did you know?

There are more than 13 000 AirBnb listings in South Africa – but many hosts are not covered if something goes wrong.

Could this happen to my business?

Guest slipping

A guest walks into the reception area and slips on the wet floor. The cleaner forgot to put out the warning sign and the customer did not see that the floor was still wet and got severely injured. Public Liability insurance covered the accommodation provider for the legal claims arising from this event.

Sneaky guest

A guest booked a last minute overnight stay and the next morning you found the bedding and cutlery as well as the guest were nowhere to be found. Theft cover compensated the business for its losses.

Get obligation free insurance quotes online in real-time

Most Frequently Asked Questions

- Digital Convenience: Get quotes and purchase coverage online in minutes.

- Tailored Solutions: Customise policies to fit your business, from a small Airbnb to a luxury hotel.

- Reliable Support: assistance and claim support from our dedicated team.

- Trusted Expertise: Leverage our industry knowledge and technological innovation to secure your business.

Need help or more information?

Get in touch with an agent that is committed to helping you protect your business.

See our Frequently Asked Questions to quickly get answers to common questions.

Email: info@bi-me.co.za

Phone: 010 446 7750