Insurance for Accounting & Consulting Businesses.

Tailored Insurance

Solutions For Accounting And Consulting Businesses

Compare free quotes

Buy online, no paperwork

Get instant cover

Get instant online insurance quotes from leading Insurers

Instant, Obligation-Free Insurance Quotes Online!

Nobody knows your business better than you, so why spend hours on the phone explaining it to someone and then wait days for a quote? When you can get quotes from leading Insurers online and compare them side-by-side to get the best deal.

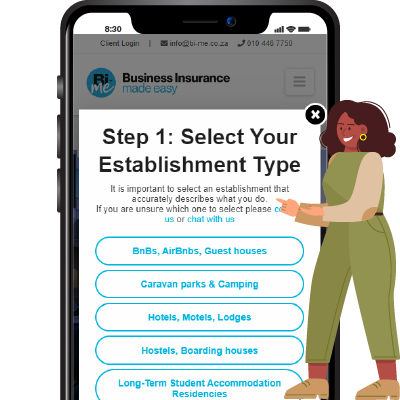

1. Select a business type

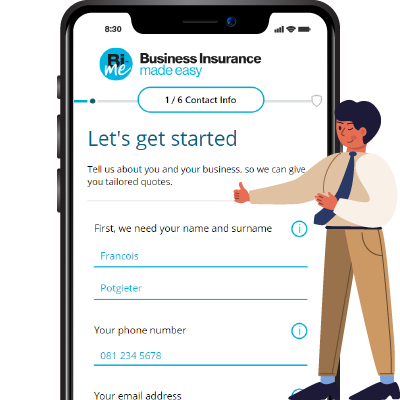

2. Tell us about you

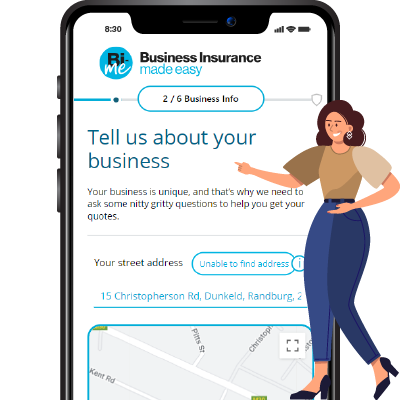

3. Customise your quotes

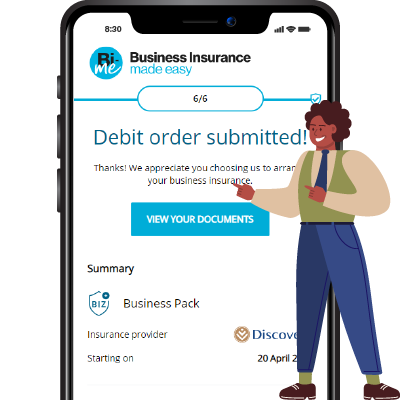

4. Get cover instantly

The Importance Of Insurance For Accounting and Consulting Businesses:

Instant Quote & Cover

Industry Leading Services

Paperless, Online Purchase

Month-To-Month

Contact

What should I consider before purchasing insurance for my accounting or consulting business?

Why choose Bi-me?

Additionally, our team of experienced underwriters understand the specific needs of accounting and consulting firms and can help you customize your coverage to suit your individual needs. With affordable options and exceptional customer service, Bi-Me is the ideal insurance partner for accounting and consulting businesses.

Fundamental Insurance Cover For Accounting & Consulting Businesses:

Professional Indemnity

Professional indemnity insurance is designed to protect your business from financial losses that might arise as a result of claims of negligence or error in the performance of professional duties. This insurance covers the costs associated with defending against such claims, including legal fees and compensation payments.

By having professional indemnity insurance, your business is protected against these risks.

Cyber Insurance

Cyber insurance is becoming increasingly important as businesses of all sizes become more reliant on technology and face a growing number of cyber threats.

Business Insurance

Business insurance for accounting and consulting businesses typically includes several types of coverage, such as professional liability insurance, general liability insurance, and property insurance.

Professional liability insurance, also known as errors and omissions (E&O) insurance, provides protection against claims of negligence, errors, or omissions in the services provided by the accounting or consulting business.

General liability insurance provides coverage for third-party bodily injuries, property damage, and advertising injuries, such as libel or slander.

Property insurance protects the business's physical assets, such as office space, furniture, and equipment, against damage or loss from events like fire, theft, or natural disasters.

Get obligation free insurance quotes online in real-time

Main Insurance Claims Your Business Could Face:

Professional Liability Claims

Professional liability insurance, also known as errors and omissions (E&O) insurance, can help protect accounting or consulting firms from claims of negligence or mistakes. Common examples of professional liability insurance claims against accounting or consulting firms include errors in financial statements, failure to detect fraud, or failure to provide adequate advice or recommendations.

Cyber Liability Claims

Accounting and consulting firms often handle the sensitive financial information of their clients, making them vulnerable to cyberattacks. Cyber liability insurance can help cover expenses related to data breaches, such as notification costs, credit monitoring expenses, and legal fees. Common examples of cyber liability insurance claims against accounting or consulting firms include data breaches, ransomware attacks, and phishing scams.

Get obligation free insurance quotes online in real-time

Need help or more information?

Get in touch with an agent that is committed to helping you protect your business.

See our Frequently Asked Questions to quickly get answers to common questions.

Email: info@bi-me.co.za

Phone: 010 446 7750