Event Liability Insurance South Africa

Cover for Event Organisers, Corporations, and Small Businesses - Fully Online, Fully Covered

Get instant cover

Compare free quotes

Buy online, no paperwork

Get instant online insurance quotes from leading Insurers

What is Event Liability Insurance?

Protect Your Event with Tailored Insurance Solutions

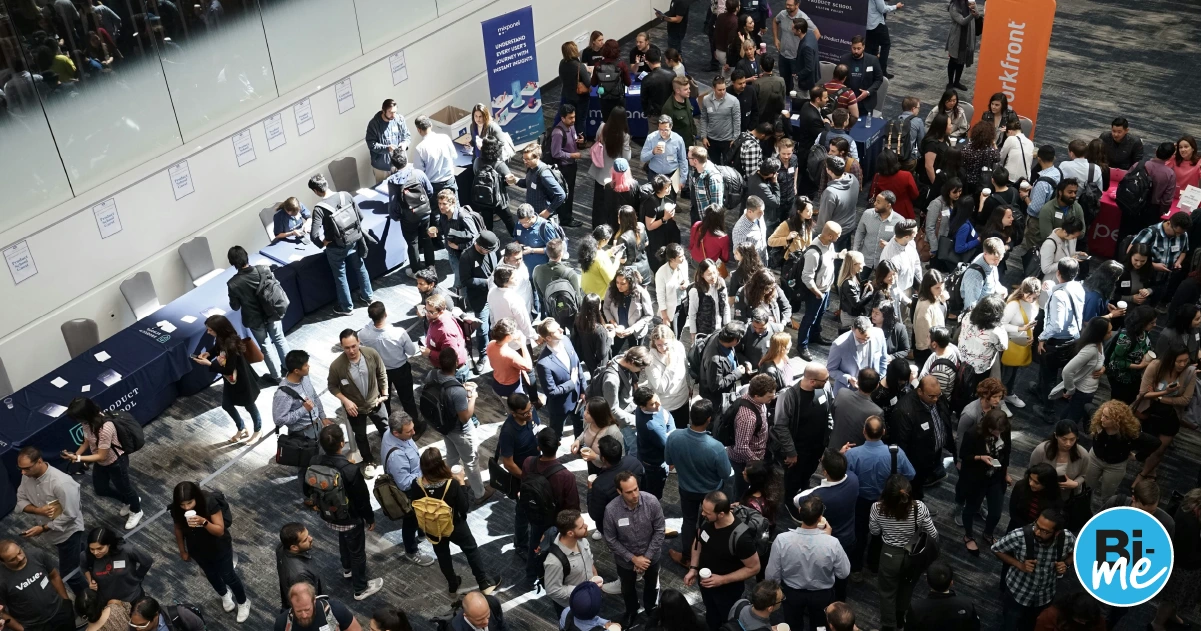

Corporate Events and Conferences

Exhibitions and Trade Shows

Festivals and Concerts

Private Parties or Fundraisers

Sporting Events

Why Is Event Liability insurance Important?

Event Liability Insurance is essential because it helps protect event organisers from financial losses that can result from accidents or injuries during an event. For a deeper understanding of how this cover can make a difference, read our blog what are the benefits of Event Liability Insurance.

Event liability insurance is also important for a few other reasons:

-

Legal Compliance: In many cases, event liability insurance is a legal requirement for event organizers in South Africa. This is especially important for event organisers who need to present their events at the Joint Operations Committee (JOC) for approval.

-

Financial Protection: Event liability insurance provides financial protection against such losses, ensuring that the organizers are not personally liable for these costs.

-

Risk Management: By having event liability insurance, organizers can mitigate the risks associated with hosting an event, such as accidents, equipment damage, or third-party property damage.

-

Venue Requirements: Many venues in South Africa require event organizers to have liability insurance as a condition for renting the space.

-

Attracting Clients: Especially for corporate clients or large-scale events, having comprehensive event liability insurance can be a prerequisite.

What Does Event Liability Insurance Cover?

Property Damage

Bodily Injury

Get your Certificate of Insurance Instantly

What Additional Coverages are Included?

Claims Preparation Cost

Statutory Legal Defence Costs

Wrongful Arrest And Defamation

Customised Event Liability insurance

Considerations When Taking Out An Event Liability Insurance Policy

THE DEDUCTIBLES

THE LIMITATIONS

THE EXCLUSIONS

Frequently Asked Questions

Event Liability Insurance provides coverage for a business or individual hosting an event in case of legal liability arising from property damage or bodily injury to a third party. To learn more, check out our blog Event Liability Insurance Guide.

Insightful Reads: Explore Our Blog Selection

Event Liability Insurance: A Comprehensive Guide for Event Planners in South Africa

How To Choose the Right Event Liability Insurance Coverage for Your Event in South Africa