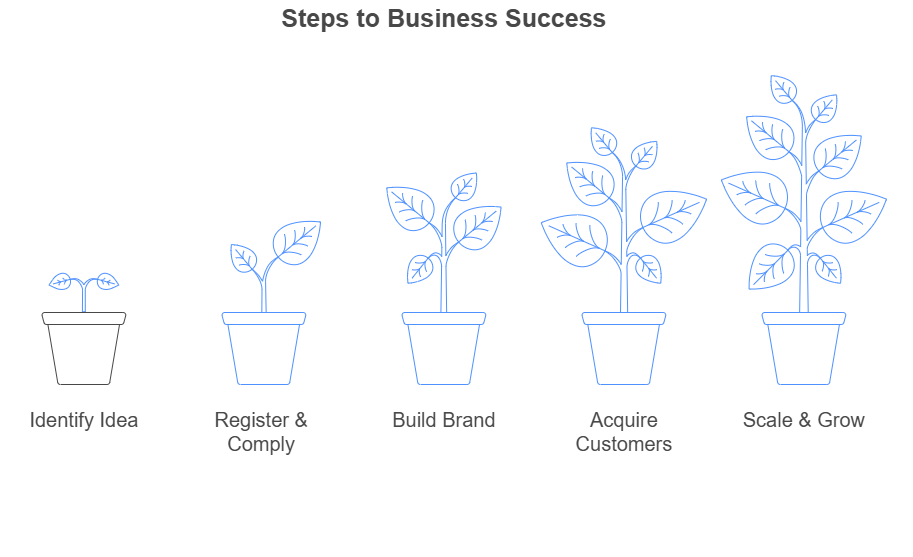

Starting a small business in South Africa is an exciting yet challenging journey. With the right approach, you can set up a profitable and sustainable business. This guide walks you through some crucial step, from idea validation to legal registration, marketing, and growth strategies.

1. Identify a Profitable Business Idea

Every successful business starts with a strong idea. Before you invest time and money, ensure your idea is viable by answering the following:

- What problem does my business solve? A business that meets a real need is more likely to succeed.

- Who are my competitors? Research other businesses in your industry to understand what works and what you can do differently.

- What is my target market? Identify potential customers, their needs, and their purchasing habits.

- How will I generate income? Outline your revenue streams, pricing model, and cost structure.

💡 Tip: Conduct surveys, interview potential customers, and analyse market trends to refine your business idea before launching.

2. Register Your Business & Meet Legal Requirements

Registering your business is an important step, but the process depends on the type and scale of your operations. If you’re just starting out and selling a few products or services on a small scale, formal registration may not be necessary. However, as your business grows, registering can provide legal protection, financial benefits, and credibility with customers and suppliers.

In South Africa, you can operate as a sole proprietor, partnership, or private company. A sole proprietorship is the simplest and easiest option for small businesses, while a private company (Pty) Ltd offers more legal separation between personal and business finances. If you plan to register, you can do so online through the Companies and Intellectual Property Commission (CIPC) website. Securing a business name is optional, but it can help you establish a unique brand.

Tax registration is another factor to consider. If your earnings exceed the required threshold, you’ll need to register with the South African Revenue Service (SARS) for tax purposes. Depending on your business type, you may also need to comply with industry-specific regulations, but for many small startups, this isn’t required. The key is to start simple, stay informed, and adjust as your business expands.

📌 Skipping legal registration can lead to fines or business closure, so handle this early!

3. Set Up Business Banking & Manage Finances

One of the biggest reasons small businesses fail is poor financial management. Separating personal and business finances from day one is critical. Opening a business bank account helps you keep clear financial records and makes tax filing much easier. Many South African banks offer tailored business accounts with low fees and extra features like online banking and business tools.

To keep track of expenses and revenue, consider using accounting software such as Xero, QuickBooks, or Sage. These tools can automate invoicing, generate financial reports, and help with tax preparation.

Budgeting is another essential aspect. Plan for operational expenses, marketing costs, and emergency funds to cover unexpected challenges. If you need funding, several options are available, including government grants, business loans from banks, and private investors. The SEFA Fund is a great resource for small businesses looking for financial support.

Keeping accurate financial records from the start will help you avoid tax penalties and ensure you have a clear picture of your business’s financial health.

4. Build a Strong Online Presence & Brand Identity

In today’s digital world, your online presence is just as important as your physical storefront. A professional website and a strong brand identity help customers find and trust your business.

A well-designed website should be mobile-friendly, fast-loading, and easy to navigate. Platforms like WordPress, Shopify, or Wix allow you to create a professional site without advanced technical skills. Your website should include essential pages like a Home page to introduce your business, an About page to share your story, a Services/Products page to highlight your offerings, a Contact page for customer inquiries, and a Blog to boost SEO and establish authority in your industry.

Beyond your website, digital marketing plays a crucial role in attracting customers. Search Engine Optimisation (SEO) ensures your business ranks higher on Google when people search for related products or services. Using relevant keywords, optimising images, and publishing valuable content can increase visibility. Social media marketing on platforms like Facebook, Instagram, and LinkedIn helps you engage with potential customers, while email marketing allows you to build relationships by sending updates and promotions.

For faster results, consider paid advertising through Google Ads or Facebook Ads to reach a targeted audience. However, consistency is key—regularly updating your website, posting on social media, and engaging with customers will help build trust and establish your brand in the market.

5. Develop a Sales & Customer Acquisition Strategy

A business can’t grow without customers, so having a solid strategy to attract and retain them is essential. Start by finding your first customers through word of mouth, personal connections, and local networking. Offering an introductory discount or free trial can encourage people to try your product or service. Partnering with complementary businesses can also help you reach new audiences. Once you have leads, focus on turning them into paying clients by providing excellent customer service, responding quickly to inquiries, and building trust through reviews and testimonials. Following up with potential customers through emails or calls can help close sales. Keeping existing customers engaged is just as important as finding new ones. Loyalty programs, referral incentives, and consistent communication can encourage repeat business and long-term relationships.

💡 Tip: Repeat customers are the lifeline of a business. Offer loyalty programs or referral incentives to keep them engaged.

6. Secure Business Insurance & Minimise Risks

Running a business involves risks, from customer disputes to unexpected financial losses. Protecting your business with insurance ensures long-term stability.

Without the right coverage, a single lawsuit or accident could financially cripple your business. Bi-me offers tailored business insurance solutions, including:

- Professional Indemnity Insurance: Covers legal costs if a client claims negligence or poor advice.

- Public Liability Insurance: Protects against third-party injury or property damage claims.

- Business Insurance: Helps cover financial losses if your business is forced to shut down temporarily due to unforeseen events.

🚀 Ready to safeguard your business? Get an instant business insurance quote at Bi-me.

7. Plan for Growth & Long-Term Sustainability

As your business grows, planning for long-term success is key. Reinvesting profits wisely can help you expand, whether it’s improving marketing efforts, hiring staff, or developing better products and services. Listening to your customers and introducing new offerings based on demand keeps your business relevant and competitive. Automating repetitive tasks, like invoicing, appointment scheduling, or inventory management, can save time and reduce errors. Staying informed about industry trends and adapting your strategy ensures that you remain ahead of the competition. Growth doesn’t happen overnight, but with careful planning and smart decisions, your business can scale sustainably and thrive in the long run.

📌 Success doesn’t happen overnight—be patient, stay consistent, and keep learning!

Key Takeaways:

✔ Identify a profitable business idea by researching the market, competitors, and target audience.

✔ Register your business legally to ensure compliance with local regulations and protect your finances.

✔ Set up business banking and manage finances effectively using tools to track expenses, revenue, and taxes.

✔ Create a professional website and implement digital marketing strategies to build your online presence.

✔ Develop a customer acquisition strategy to attract and retain clients, ensuring consistent growth.

✔ Secure business insurance to minimise risks and protect your business from unexpected events.

✔ Plan for growth by reinvesting profits and staying updated on industry trends to ensure long-term sustainability.

*This is general information only and does not take into account your financial situation, needs, or specific objectives. As with any insurance, the cover will be subject to the terms, conditions, and exclusions contained in the policy wording.